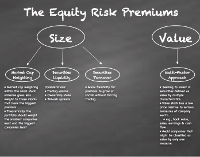

Vericimetry believes in providing broad asset class exposure to the size and value risk premiums. In implementing such a strategy, we have our own unique approach to most effectively capture these risk premiums.

Size: It has been observed and well documented in the academic literature that over longer periods of time, stocks with small capitalization tend to outperform their larger peers. Yet many portfolios are formed based on cap weighting, giving the highest weights to those stocks with the lowest size premium. Considerations of liquidity, turnover and capacity do make cap weighting a reasonable base case scenario. At Vericimetry, we seek to enhance our small cap premium by:

- Lowering our upper market capitalization size boundary when defining our small cap universe;

- Extending our lower market capitalization size boundary deeper into the set of small cap stocks; and

- Allowing deviation from cap weighting, with greater deviations for the smaller stocks.

We believe in a flexible and efficient implementation, not forcing any stocks into a strategy, but rather trading patiently as liquidity allows.

Value: The empirical case for investing in Value stocks is even stronger than that of Size. In particular, over longer time periods, stocks that are traded at a “discount” with respect to some financial factors have provided higher returns than growth stocks. At Vericimetry, we use a multiple factor approach to define our Value stocks since it has been shown that no single factor (e.g., Book-to-Market) can consistently provide the highest risk permia among other risk factors. Vericimetry uses a composite score of various risk-premia factors (e.g., Book to market, Earnings to price, Sales to price or Cash flow to price) to define a Value stock.